Agree with you on this 100% as many of my friends make more money than me yet they are all in debt up to their eyeballs. They live outside of their means. I actually live quite modestly yet I have much more to show for it then they do.

My buddy went out and bought a brand new Lexus with the flashy rims, DVD player and everything. He’s struggling right now to make his insurance payments, his car payments, his rent, and he’s not getting foodstamps because he makes too much money but I’m looking at the guy and he needs to borrow money from me just to eat lunch.

I know exactly what I want to do with my money and I avoid liabilities like new cars and usually drive an older vehicle and save that money.

I really appreciate this sort of practical and realistic thread that I think is exactly what many budding magicians need. Especially when they start having prosperity but can’t handle it enough for it to be beneficial.

I have found that the approach that works for me is to address the Epicurian dilemma. I refuse to sacrifice my personal standard of living for financial solvency, so I devote the lion’s share of my fruits towards the furthering of my passions while at the same time having become very good at eliminating expenditures on things I find no value in. I am fortunate in that I do not have expensive pursuits, lol.

But having a car with all the trappings is not an issue if you approach the scenario appropriately. I am a big fan of Robert Kiyosaki. He advocated in one of his books to create or obtain an asset that ultimately pays for your luxury, before you place the burden of the luxury upon yourself. That way, once the luxury is paid off, you still control the asset and reap the benefits. This is just one way that wealth is amassed while still making it worthwhile in the immediate context.

The importance of delayed gratification and sound planning can not be understated.

Yes I find I’m more interested in spending my money on good experiences rather than material items. I intentionally factor in my weekly sushi buffet to my budget. Lol

But having the big flat screenbtv is not on my priority list since I don’t think it’s in any way necessary. I did spend about a grand going to the X files 20th anniversary convention. But it was totally worth it because that’s how I spend my money Lol.

Bookmarked, copied to friend and saved to drive for further use.

Nice discussion. It’s important to know whether you’re an occultist or not. I’ll follow this thread.

It would not matter if one was an occultist or a crackhead; the same financial principles still apply. Money and the laws surrounding it work the same for both practitioners and mundane people. It’s just that occultists have extra tools to work with.

Correct.

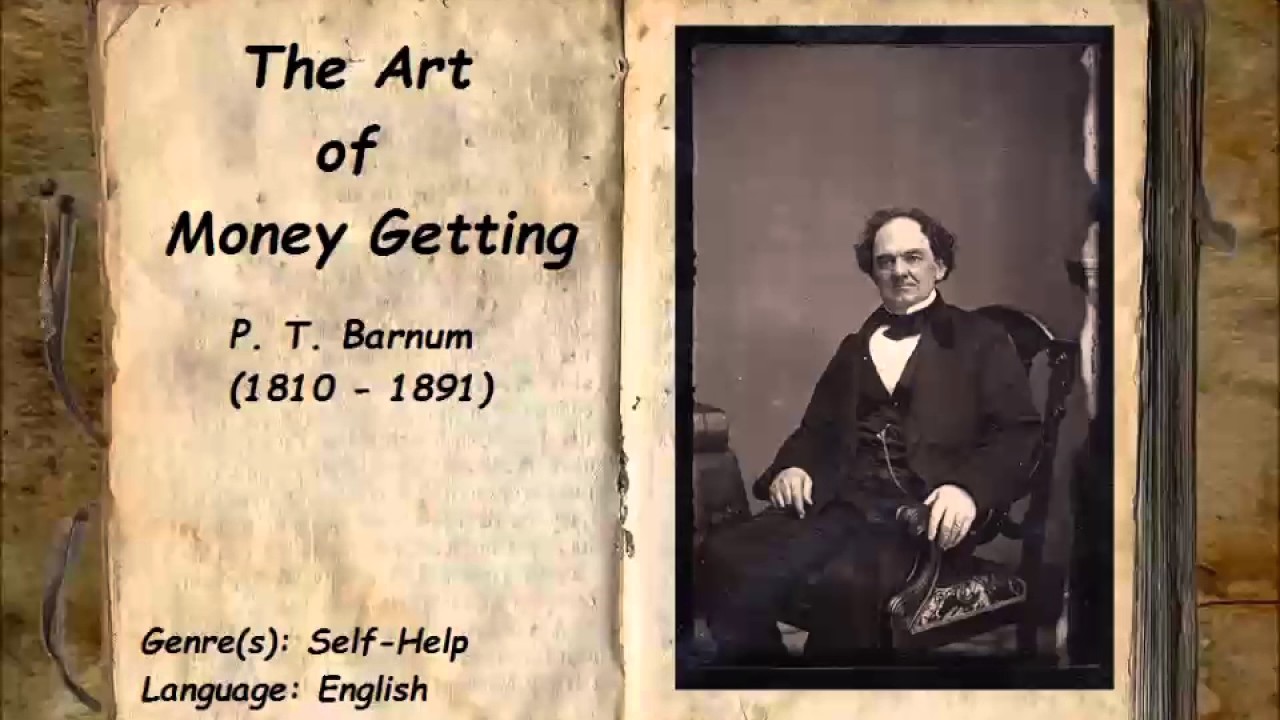

Here is a book that i found most useful. Wish i t had been written when I was younger.

I’ve really gotten the grasp of being financially aware since moving across the continent all on my own. I recently purchased a newer vehicle, which will suit me for work because it has room for my tools and supplies. We could afford to live in some of the nicest apartments in town for upper middle class folk, but it’s just unreasonable to strain ourselves financially to look like we have money. Most of our money goes to food and music equipment. I’ve never really been the materialistic type. Get a vehicle that suits your needs, unless you have no needs, then you’ve got room to get what you want. Don’t live somewhere unreasonably expensive if you don’t need to. There’s probably a nice apartment complex up the road for $400 a month less in just as nice a part of town. Learn to cook, even if you’re only good at a few meals. It saves you SO much money not eating out 6 or 7 days a week. Of course, sushi outing is priority.

It’s so funny, yet so sad, to see people making nearly double what I do struggling to make ends meet when they could just cut back on their expenses and maybe stop buying stuff that they aren’t going to use daily. Music equipment is an exception for me because I’m inclined in that direction and you need good gear to sound good. Back to my point, stop spending your money poorly, especially if you have to work for it.

I’m working with Holly Alexander’s Magic Money series. Genevieve Davis has a similar book series, but i’m already committed to Holly’s work so i’m going to stick to that. I’ve learned a ton from her books.

I also use The Work and EFT tapping in order to change my belief system and money blocks. This is uncovering a lot of self-sabotage i find challenging to move. I operate on the principle that i am responsible for my destiny, and most of the blockages stopping my ascent are in my own mind.

100%. The second you take ownership, you declare sovereignty in a way. Kings and Queens do this, and while the act of doing so is not without it’s own dangers and pitfalls, the rewards may yield a kingdom.

Cheers!

In the US, unofficially, you need to make 10% return to outpace inflation by 1%-3%. Officially inflation is listed at 2.5-3% but that is because they remove the numbers that make it look higher by changing their rules for calculation every time. They game the data to keep everyone thinking everything is good…like Enron, but Enron did something illegal…go figure.

EFT tapping is underrated

I contacted the angelic spirit Labusi and they told me to read The Richest Man In Babylon by George S Clayson. I imagine this book was what inspired Kiyosaki’s “Rich Dad.”